Helping accountants to provide more value

Intelligent advisory software for accountants that focuses on the individual behind the business.

Your Clients' Business and Personal Goals, Intertwined...

Features

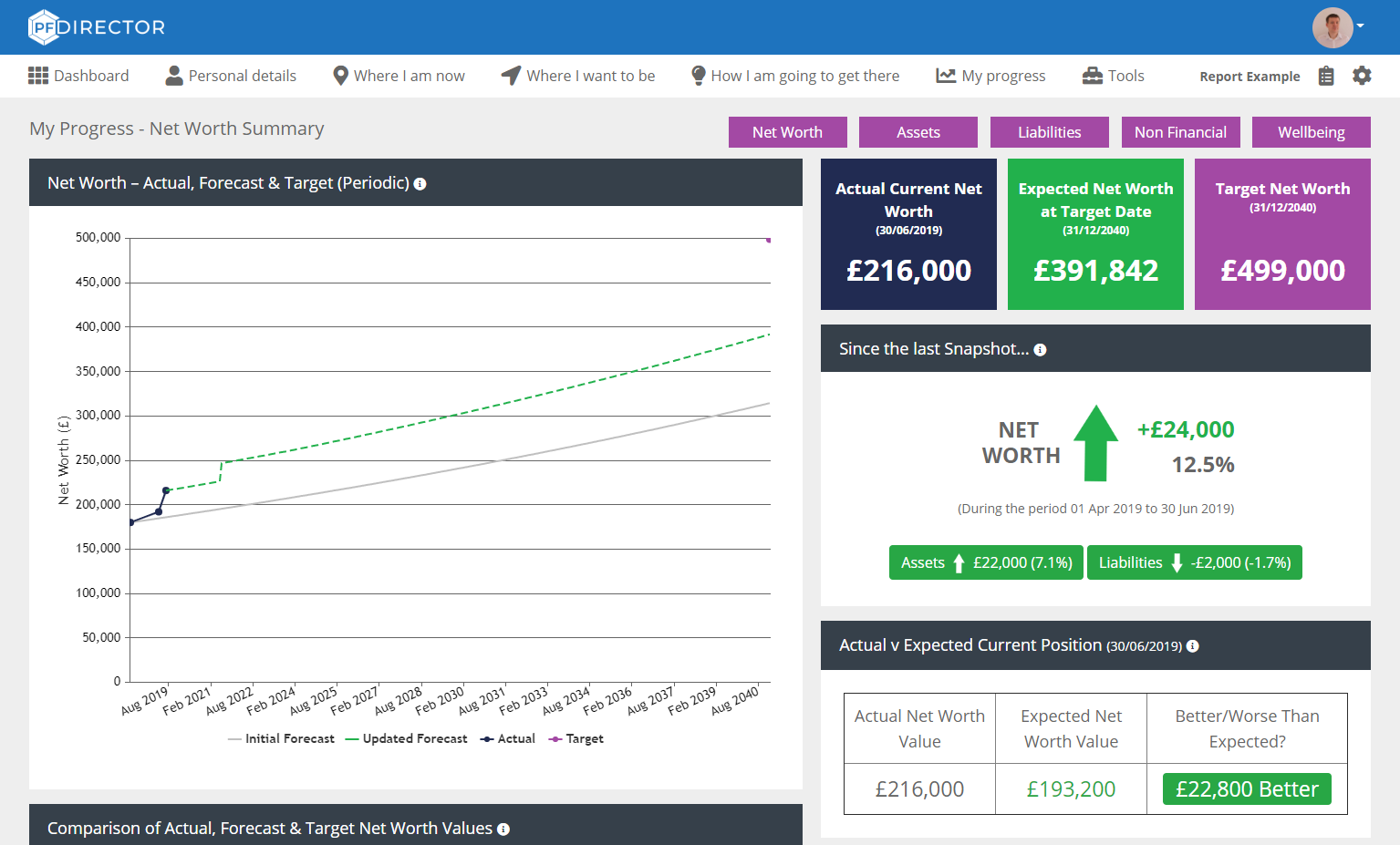

Goal Setting & Tracking

Identify your clients' financial (and non-financial) goals. The goal may be a particular net worth figure at a particular retirement date. Setting an objective target allows you to quantify progress and suggest improvements.

Smart Advisor Function

Our intelligent algorithm looks at all of the information that has been provided by the client. The system then works behind the scenes to identify potential personal wealth and tax planning opportunities.

Flexible Snapshot System

Create regular snapshots of your clients' personal assets and liabilities. You and your clients choose how often you wish to revisit and update the advisory process.

Personal Wealth Hub

We have an ever-expanding database of money saving and cash generating tips and tricks that you, as the advisor, can search through before adding specific items to the client's action plan.

Action Plan

Devise a plan with your client on how they are going to reach their financial target/goals. Specify the financial impact of each item, when each impact will occur and who will be responsible for each action.

Tax Planning Hub

Search and filter our database of UK tax planning ideas. Relevant items can then be added to the action plan along with your estimate of the financial benefit to the client - allowing you to generate additional fees.

Powerful Reporting

Generate high value and meaningful reports for your clients that clearly and visually show the progress that the client has made towards their targets. Reporting is broken all of the way down to an individual asset and liability basis.

In Depth Forecasting

In addition to the action plan, the advisor can forecast complex future transactions through 'future' double-entry bookkeeping journals. e.g. showing the effect on all individual assets and liabilities when a property is purchased with a mortgage.

Client Login Area

Choose whether to let your clients log in to view their progress in their own time by providing them with their own separate login credentials.

Inheritance Tax Analyser

Automatic high-level inheritance tax position analysis which is based upon the client's target net worth value. A great way of moving the conversation with the client onto IHT planning, wills and other estate planning services.

Team Members & Access Rights

Setup multiple advisers and multiple team members. Allocate access to specific clients to other team members. Restrict team members' access to specific features, helping you to delegate tasks appropriately.

Client Data Input

Allow your client to input their latest snapshot data directly into the portal themselves prior to the next meeting/review. Automatically send out reminder emails to clients when they need to do something. A great time saver.

Co-branding

The adviser's details are built into the PF Director portal and reports as standard, ensuring that your branding and position as trusted adviser is at the forefront of your clients' mind.

Wellbeing & Non-Financial KPIs

As well as looking at your clients' financial performance, PF Director gives you the ability to map and measure non-financial factors - such as stress levels, work/life balance, happiness etc.

Impact Statement

Identify the value that you are providing to each client - either on an individual snapshot basis or cumulatively since the first snapshot. This makes it easy to tie the benefits you provide with your adviser fees.

Ongoing Support

Receive 1-to-1 onboarding (and periodic 'catch-up') support via your dedicated account manager as standard. We also provide guided walk-throughs for all common tasks built within your Dashboard.

The benefits of partnering with PF Director...

Provide More Value

PF Director systemises the proactive nature of your advisory offering, giving you the opportunity to provide significant value to the client at every stage of the snapshot cycle.

Increase Fee Income

PF Director makes it easy to obtain a substantial amount of additional fee income from existing (and new) clients. The conversations which flow naturally from the systematic advisory process lead to additional high value work.

Save Time

PF Director's Smart Advisor Function cuts down hours of exploratory tax and financial planning work. High value reporting is available at the click of a button.

Build Deeper Relationships

Build stronger and deeper relationships with your clients. The advisory process focuses on the individual's wants and needs first, rather than solely on their business.

Differentiate Service

By providing a proactive advisory service that focuses on the individual, you are positioning your practice as different to the competition.

Become Trusted Advisor

Build up trust with your client base through regular, meaningful contact which allows you to become the 'go to' person when the client requires advice.

Retain More Clients

It goes without saying that a happy client will stick with you for the lifetime of their business (and beyond). PF Director helps you to look at the client's bigger picture using a long-term, iterative process which clients want to see through to the end.

Obtain More Referrals

Most advisers know that client referrals can be the lifeblood of the firm's marketing engine. It makes complete sense that a well-advised client will spread the word (if not shout) about your service.